Create your own platform where customers can manage their finances

White Label PFM revolutionises the way end-customers manage their finances and offers a 360-degree view of their financial life.

Product description

What is White Label PFM?

The solution provides advanced personal finance management tools to improve user experience and drive customer engagement to a whole new level.

With the help of Salt Edge Account Information and Payment Initiation APIs, your end-customers can link all their bank accounts from 5,000+ financial institutions in over 50 countries to your app.

- All types of accounts: current account, savings, checking, mortgage, loan, insurance

- Bank statement with transaction details

- Account holder information

- Notification alerts for balance thresholds

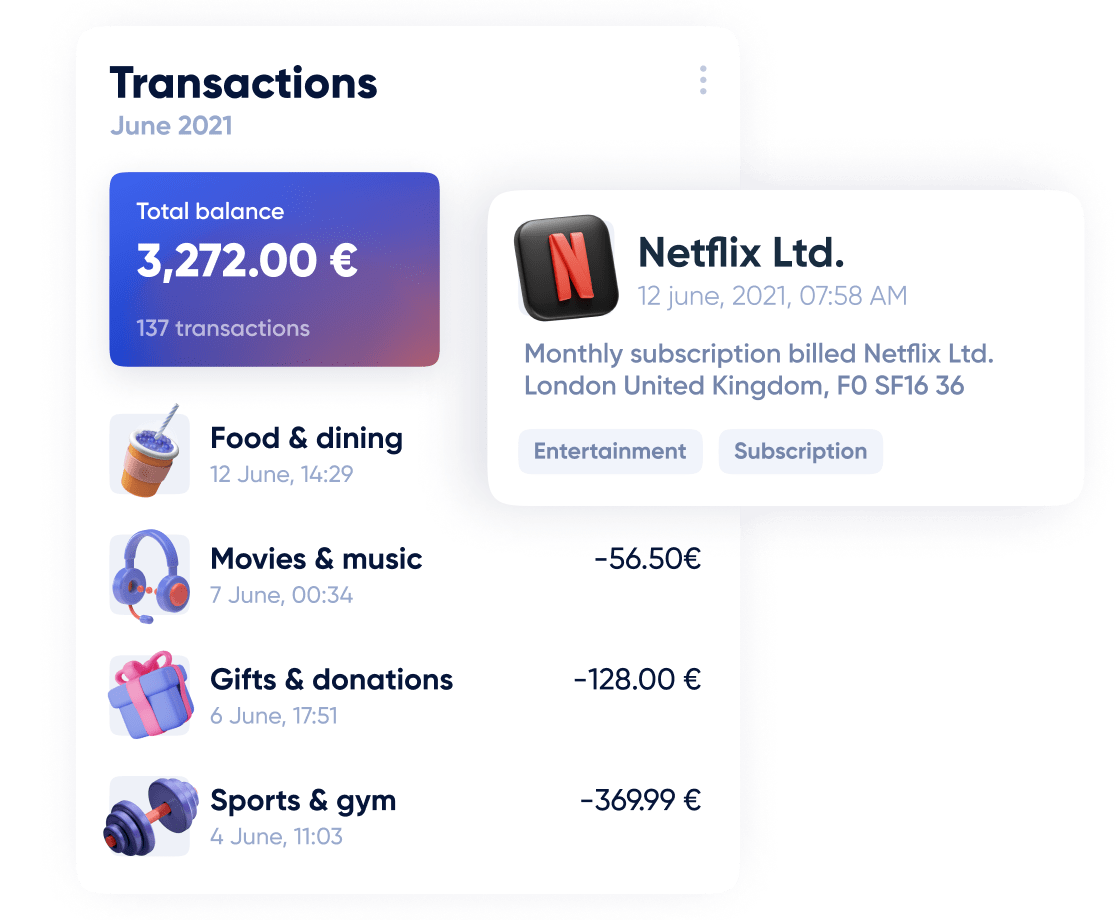

Data Enrichment

Transaction Categorisation, Merchant Identification

Unify your end-customers’ transactions across all their accounts in one place - your banking app.

- Unified information

- Normalised data

- Self-learning categorisation engine

- User-driven re-categorisation

- Merchant identification and mapping

Digital boost to financial management

Financial planning

Daily financial planning can be automated by implementing the flexible functionality of White Label PFM, which enables

end-customers to easily manage financial budgets, schedule payment of bills, and more.

- Setting up a monthly plan for bills, savings, and day-to-day spendings

- Receiving an automated monthly budget plan based on spending history

- Reviewing past spending patterns based on categories and time intervals

- Getting timely reminders and warnings to stay within budget limits

Smart budgeting and saving tools

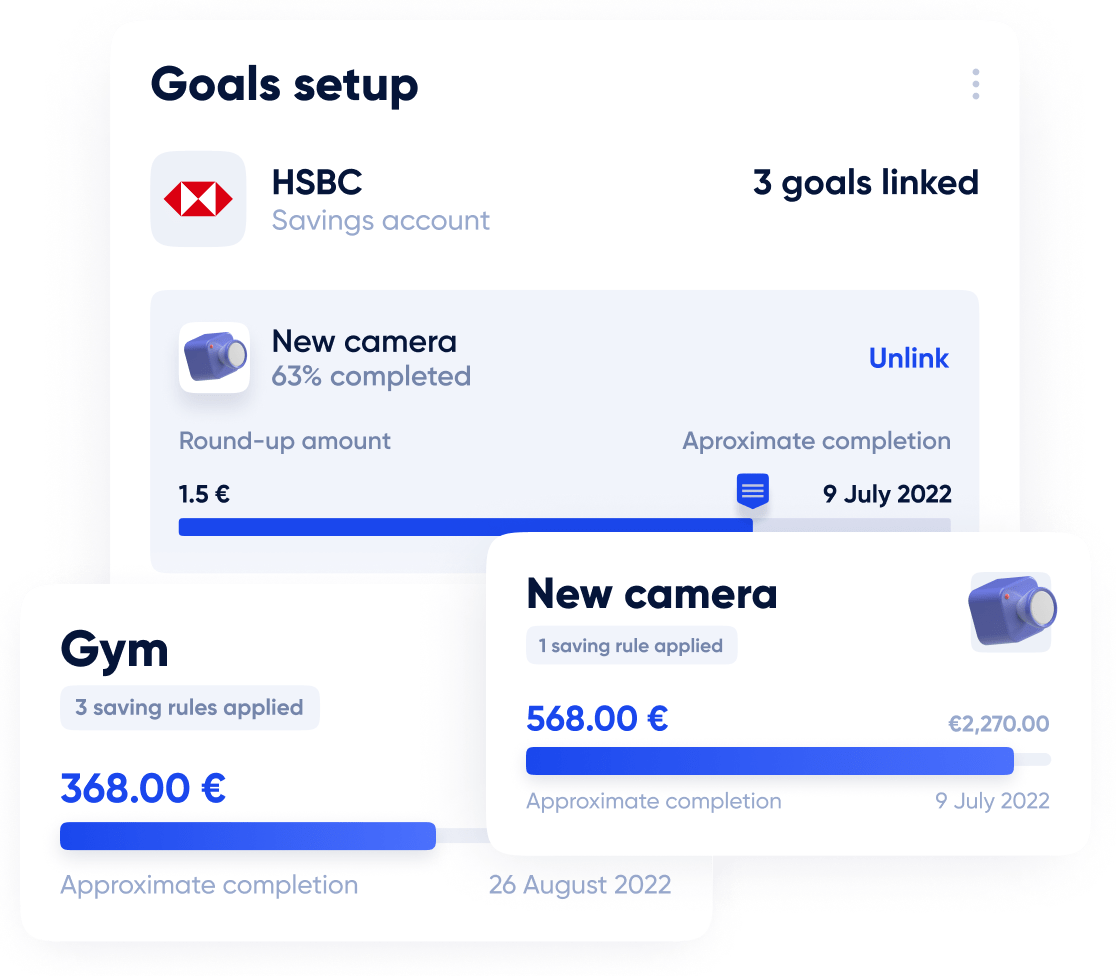

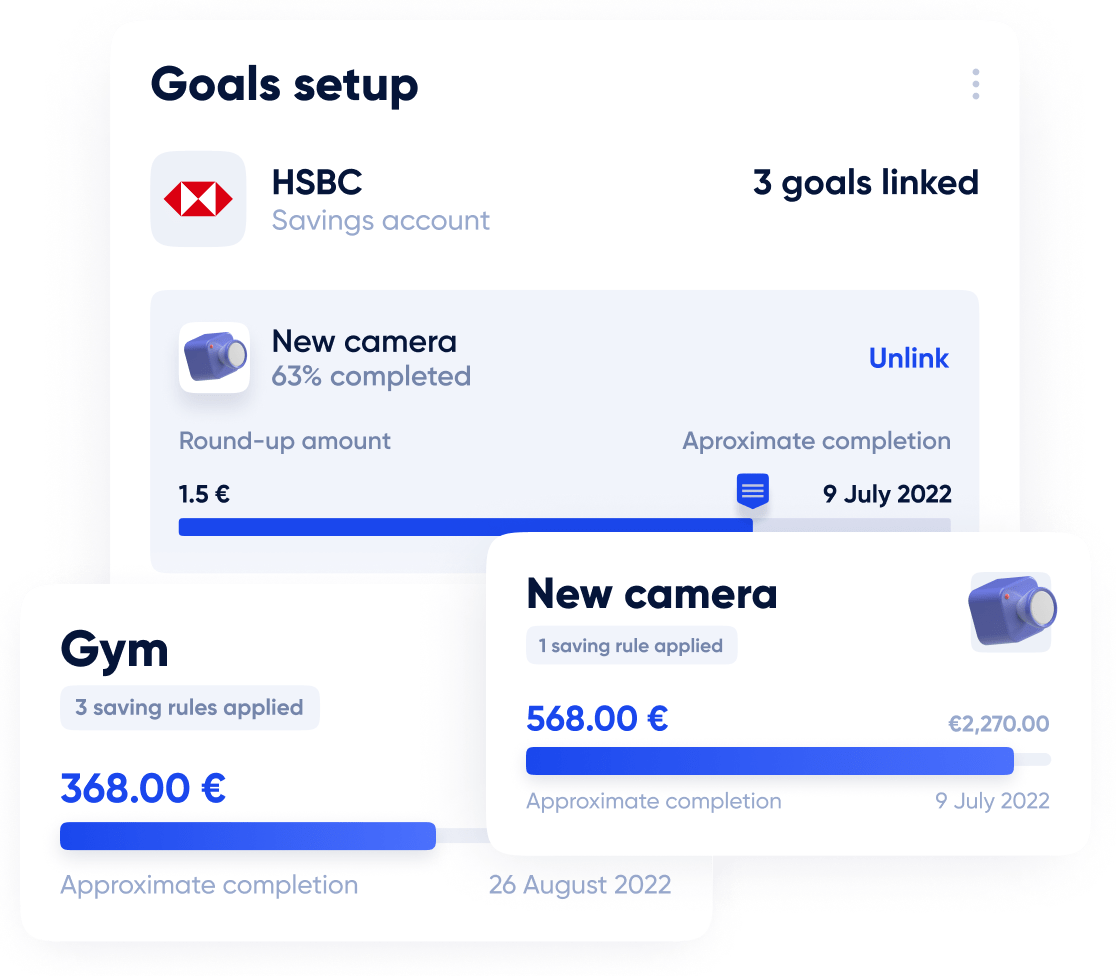

Saving goals

Help your customers to set short-term, mid-term, and long-term financial goals. Equipping your customers with comprehensive tools to track their financial progress is an important step toward becoming financially secure and achieving their targets.

- Setting up a Saving Goal and tracking progress through a linked savings account

- Estimating how much time achieving goals will take

- Personalising goals by adding categories and photos

- Getting notifications on goal progress

Automated financial planning

Day-to-day advice & notifications

Daily financial planning can be automated by implementing the flexible functionality of White Label PFM, which enables

end-customers to easily manage financial budgets, schedule payment of bills, and more.

- Drive your end-customer engagement to new heights by offering day-to-day guidance

- Receiving an automated monthly budget plan based on spending history

- Reviewing past spending patterns based on categories and time intervals

- Getting timely reminders and warnings to stay within budget limits

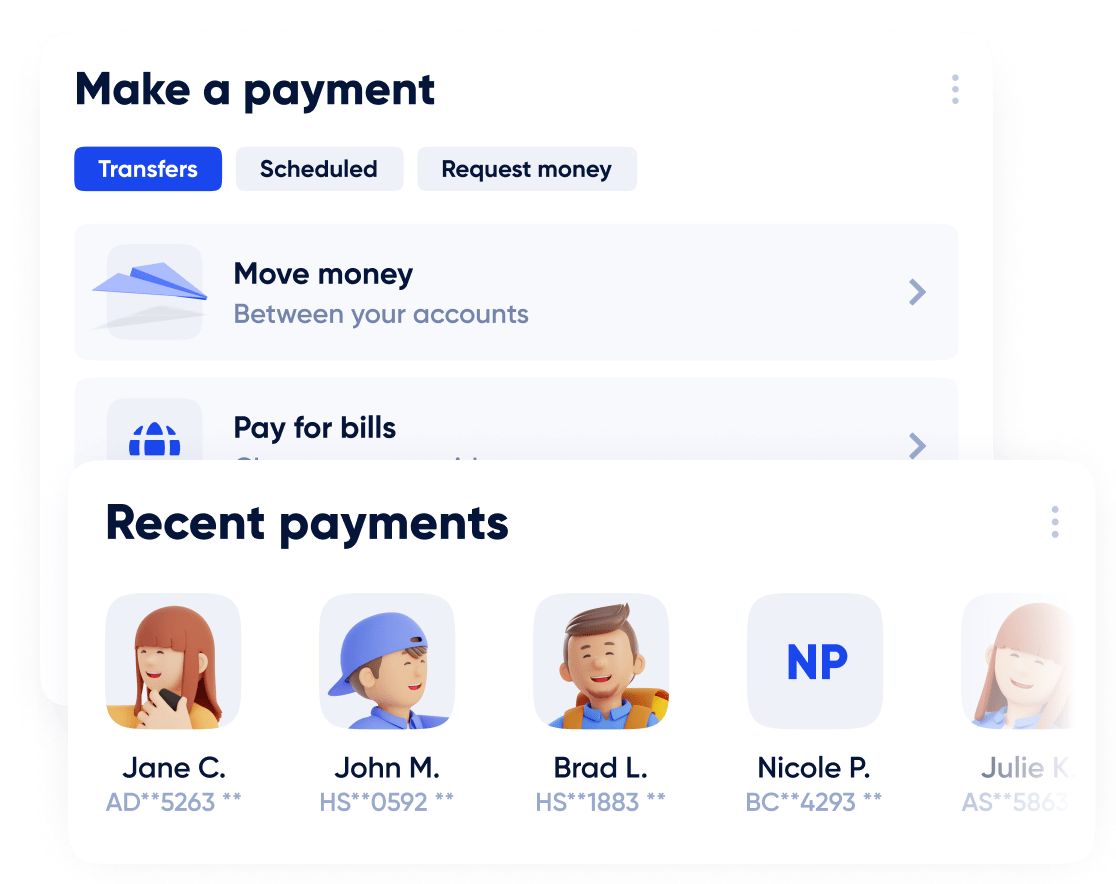

Instant and lower-cost payment experience

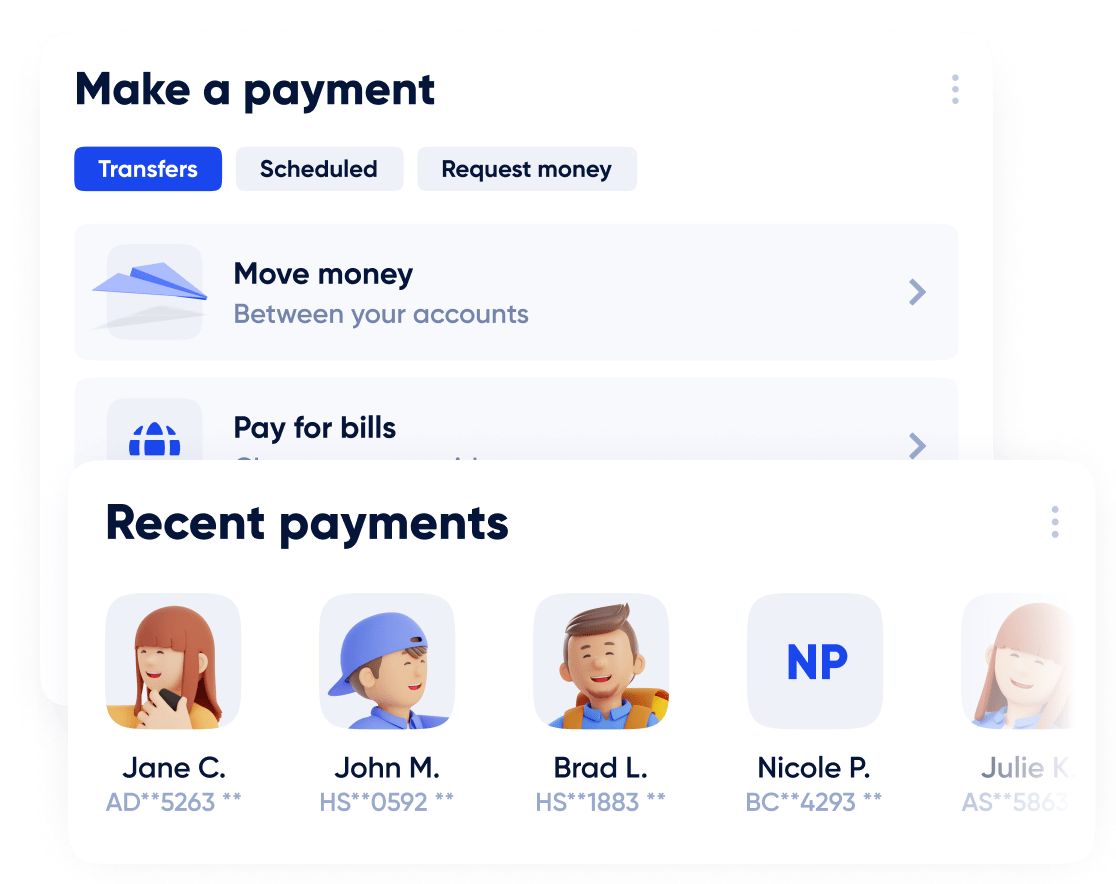

Payments via open banking channels

Integrate Salt Edge’s Payment Initiation API that enables

end-customers to move funds from their accounts in any EU bank institutions, directly from your PFM app.

- Transfer funds between accounts

- Make instant payments

- Pay invoices

- Make national and international transfers

- Request money from a friend