SaaS solution with all open banking requirements covered, offering a cost-effective and technically scalable approach to compliance.

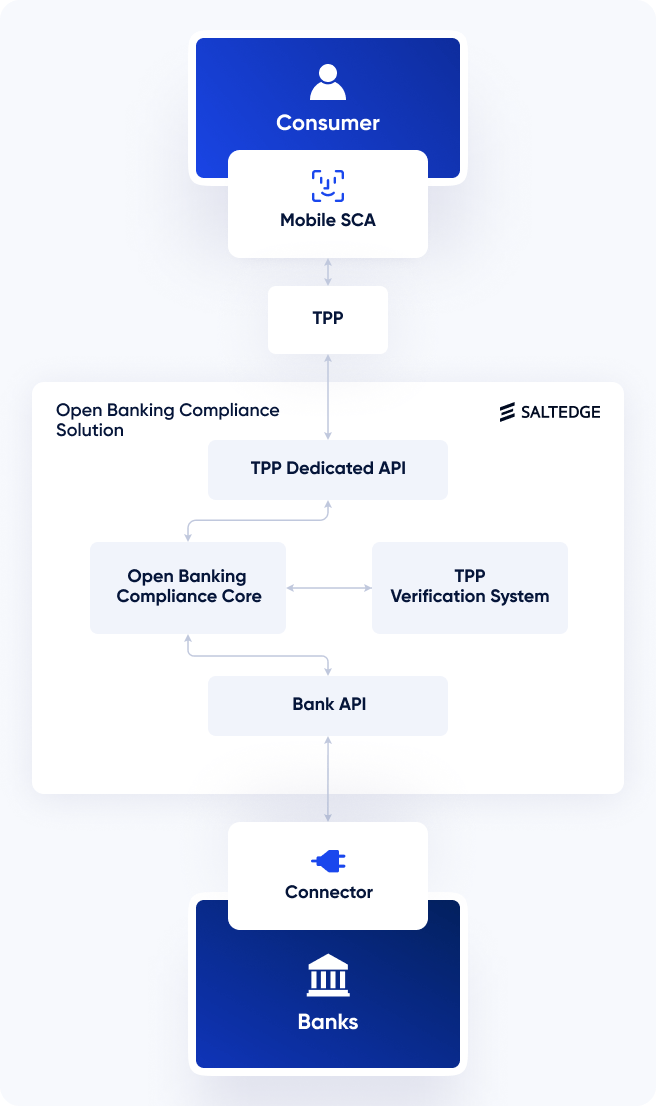

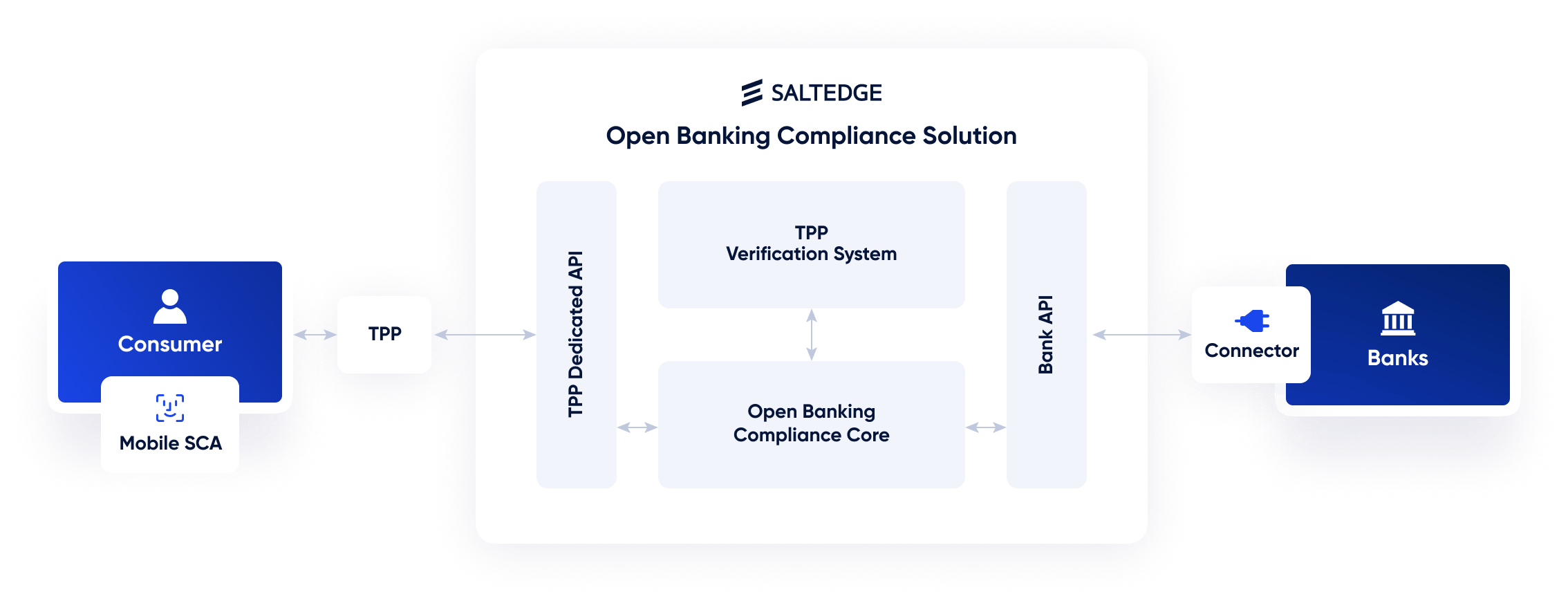

Main components

Become fully open banking compliant in just 1 month

Salt Edge Open Banking compliance is a SaaS solution that covers all essential components, so you can enjoy fast, secure, and seamless experience. Get armored with:

- Comprehensive set of APIs, including AIS and PIS

- A full TPP dedicated environment that includes a TPP dedicated API, ticketing system, monitoring dashboard, and more

- A comprehensive ASPSP dashboard to see insights and monitor performance at-a-glance

- TPP Verification system to know exactly who is connecting to the API

- Mobile SCA solution for secure actions

TPP dedicated environment

Full-service

environment for TPPs

The TPP dedicated environment includes a set of required APIs - AISP, PISP, and PIISP - alongside the detailed documentation for developers. The latter is meant to help third parties to have a seamless integration and interaction with the Open Banking channels, as required by the regulation. The environment provides a testing facility that mirrors all the functionalities from the production environment for seamless TPP integration and provides first-line support for TPPs. Salt Edge handles all the communication with TPPs, minimising the hassle of tasks required from the bank’s side.

TPP Verification

Shield your customers’ accounts by filtering TPP access

To keep customers’ accounts safe, banks and EMIs must have in place a mechanism that identifies and verifies TPPs which request API access. Developing such a solution in-house is off the table due to required technical and organisational efforts.

Salt Edge TPP Verification system is a ready-to-use solution that covers all essential components to guarantee secure and fast TPPs identification.

Mobile SCA

Strong customer authentication for complete protection

Mobile SCA app meets the strong customer authentication (SCA) and dynamic linking requirements aimed to make online payments safer and increase customer protection.

The solution combines the world's best UX and security practices. Mobile SCA simplifies the access to banks’ and EMIs’ channels, granting a user-friendly and secure authentication and authorisation process.

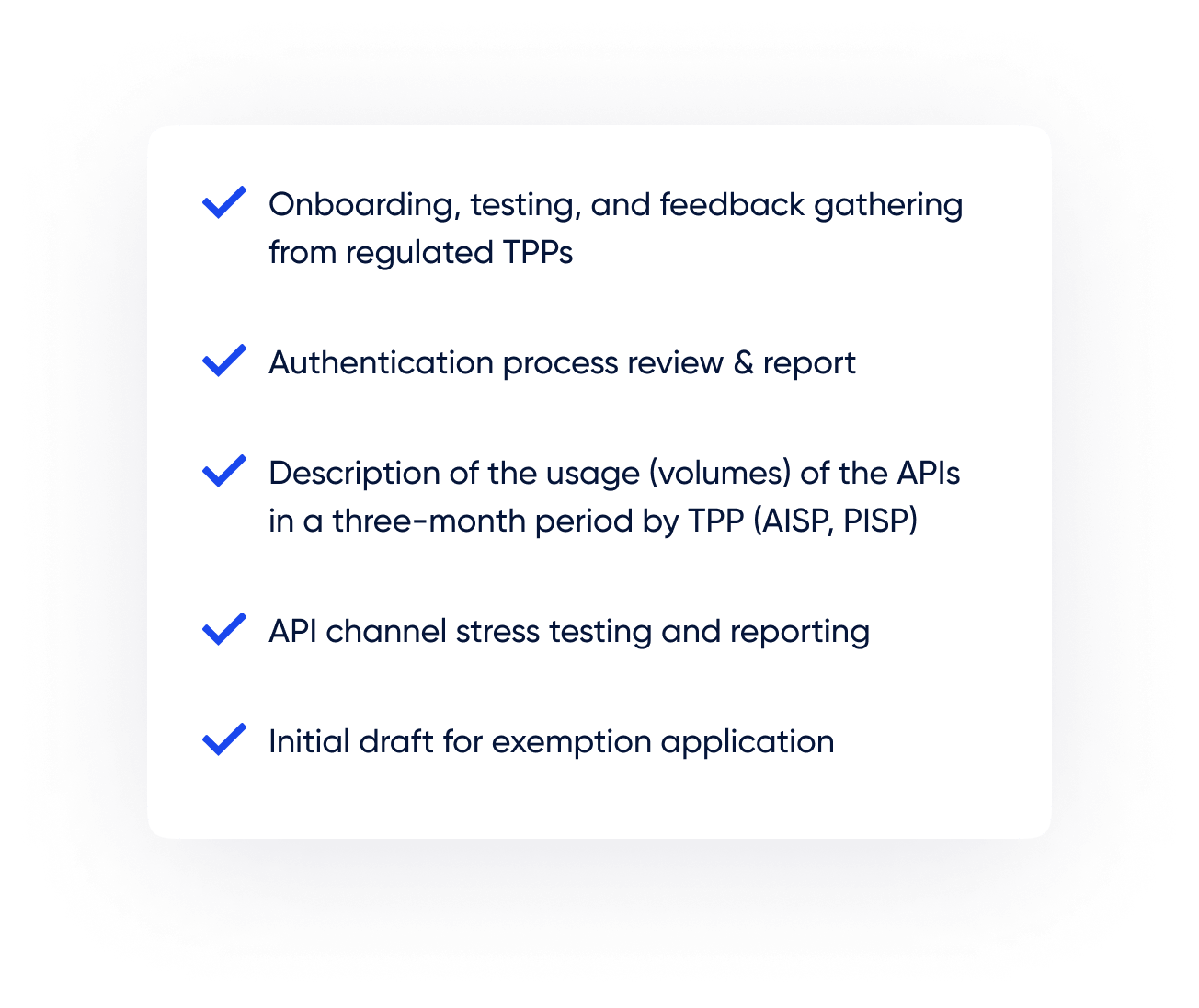

Exemption from fallback channel

Break free from extra regulatory obligations

Banks and EMIs are obliged to provide a contingency mechanism that TPPs can use in case the API does not work as expected. Building and maintaining such mechanisms involve significant expenses.

Salt Edge can assist ASPSPs who wish to apply for regulatory exemption from the obligation to set up a contingency mechanism.

Use cases

Explore the potential of

compliance for

Benefits

A cost-effective and technically scalable approach to compliance

They trust Salt Edge