5,000+ worldwide banks via 1 API. Access end-users' bank data from all accounts in a unified, easy-to-read format.

Coverage

Expand your business globally

Access the open banking data across Europe and beyond with Salt Edge.

Never stop growing. We keep testing and adding new bank connections so you can enjoy a gateway to any bank account.

See full coverageHow it works

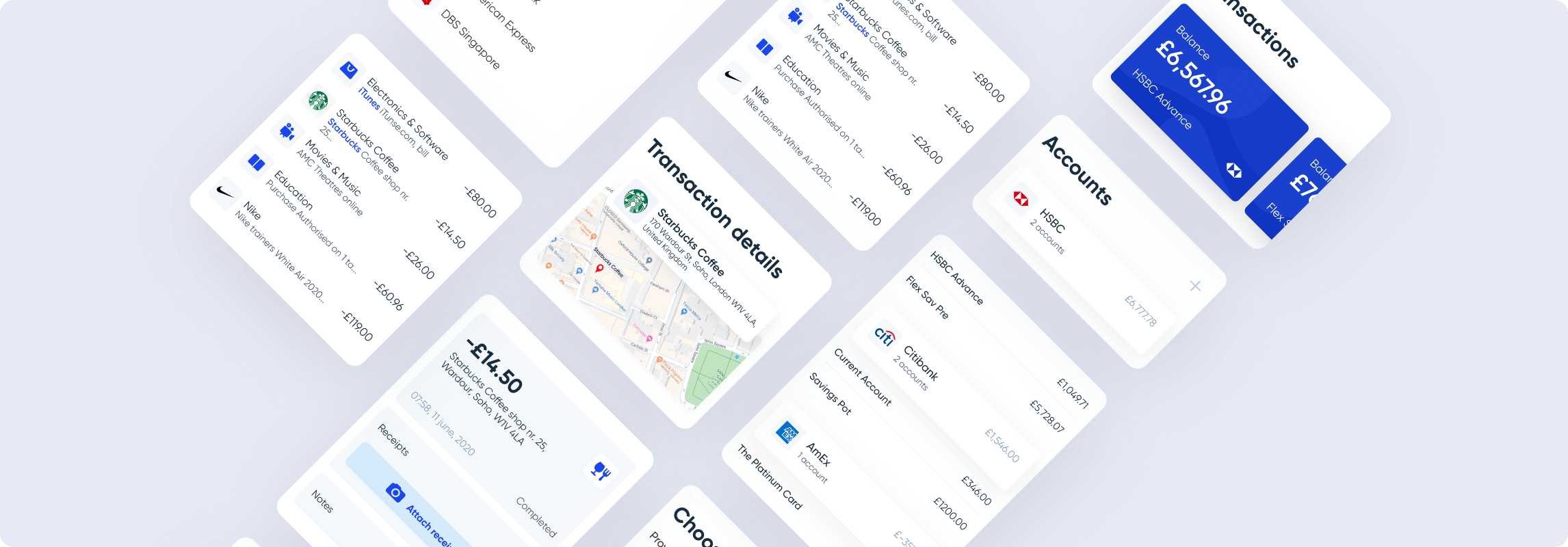

Frictionless user experience

Enable your customers to enjoy the benefits of fast and frictionless flow. Salt Edge solution comes with a pre-integrated widget, where end-users can select and securely connect their accounts to your app.

The widget can be customised under your branding, making

end-users feel comfortable and safe from the first click.

Data Enrichment

Transform raw data into meaningful insights

Salt Edge data enrichment services offer meaningful insights to help businesses understand their clients’ financial needs better and deliver innovative products with improved user experience.

- Transaction Categorisation

Transforms unclear transactions into actionable data - Merchant Identification

Instantly detects the merchant for any transaction - Financial Insights

Creates a detailed report on customer financial behaviour

Data Aggregation. Partner Program

No PSD2 licence to expand across Europe? Try Partner Program

Connecting to banks across the EU is like a brain-teaser that requires highly secure infrastructure, PSD2 licence, and open banking expertise. With Salt Edge Partner Program you get instant access to aggregated EU bank data in an easy and compliant way.

Focus on providing innovative services based on real-time customers’ data, while Salt Edge handles all the technical, compliance, and security matters.

to

- No more manual input. All account data is inserted automatically in just one click

- Get a complete financial overview and manage properly the financial flows by having data from all accounts in one place: current, saving, mortgage, investment, loyalty

- Enable your clients to get custom saving and investment tips based on insightful data

- Budget wisely, set alerts for payments' due dates and credit limits

- Equip your clients with the possibility to connect all their accounts held at other financial institutions to your banking app

- Increase customer loyalty by providing an aggregated view of all finances, transaction history, and spending categories in one place

- Improve user experience by offering a cost-effective and time-saving solution

- Start using real-time financial data directly from banks from across all Europe and beyond, mitigating risks associated with outdated information

- Verify instantly the sources of income (basic salary, freelance, expat) directly from the transaction history

- Improve accuracy of credit scoring calculation by designing a quicker and more reliable credit assessment model

- Determine borrowers' lending limits based on their spending habits

- Take lending decisions fast and easy as one-two-three

- Benefit from open banking data even without having your own PSD2 licence and eIDAS certificates

- Get instant access to clients' open banking data in an easy and compliant way to automatise accounting services: automatic import of transactions, simplify taxes calculations, account reconciliation, facilitate invoice fulfillment

- Break free from Excel spreadsheets avalanche - automate billing services

- Reduce administrative burdens, and deliver new digital and financial services to businesses

- Provide a quick overview of the company's financials for efficient enterprise resource management

- Create comprehensive real-time reporting features to accurately measure business progress

- Kit up the outdated, inefficient, and costly due diligence processes with instant bank connectivity

- Verify customers' identity in no time with reliable account holder information (name, address, contact details) from the bank

- As an advanced KYC measure: fetch account information (account name & number, balance) straight from the customer's bank account

- Accelerate conversion: simplify the complex KYC procedures that might create friction and affect user experience

- Cut expenses by speeding up the client onboarding process

- Get a real-time view of corporate financial data by connecting all accounts from any bank, in any country to one app

- Tackle the classical cash management challenge for corporates: save time and money by ensuring that C-level executives take efficient and informed decisions thanks to improved overview

- Reach a new level of digitalisation by accessing all business financial data in one single format and sharing it easier with auditors, tax authorities, potential investors in an automatic way

- Remove dull manual work of managing and monitoring your financial situation, get a real-time picture to identify vulnerabilities, like unnecessary expenses

- Speed-up tenant verification. Tenant vetting organisations can speed up the verification of tenants' financial situation from 36 hours to 4 minutes

- Calculate the carbon footprint. By connecting directly to the users' bank feed, apps can calculate the carbon emission of everyday purchases like food, clothing, and travel, and allow users to offset the emissions automatically by supporting global reforestation projects

- Donate in a new faster way. Apps can raise millions through analysing transactions and adding up pennies left from payments, then donating them to charities and non-profit organisations of customers' choice

Benefits

Find the solutions to your challenges in every Salt Edge product

At Salt Edge, we've got you covered with a range of unique ready-to-use products. Our open banking platform is designed to help you build smart and innovative services through the power of open financial data. You can count on us to solve your specific business needs and add value for you and your customers.

They trust Salt Edge