Open banking benefits

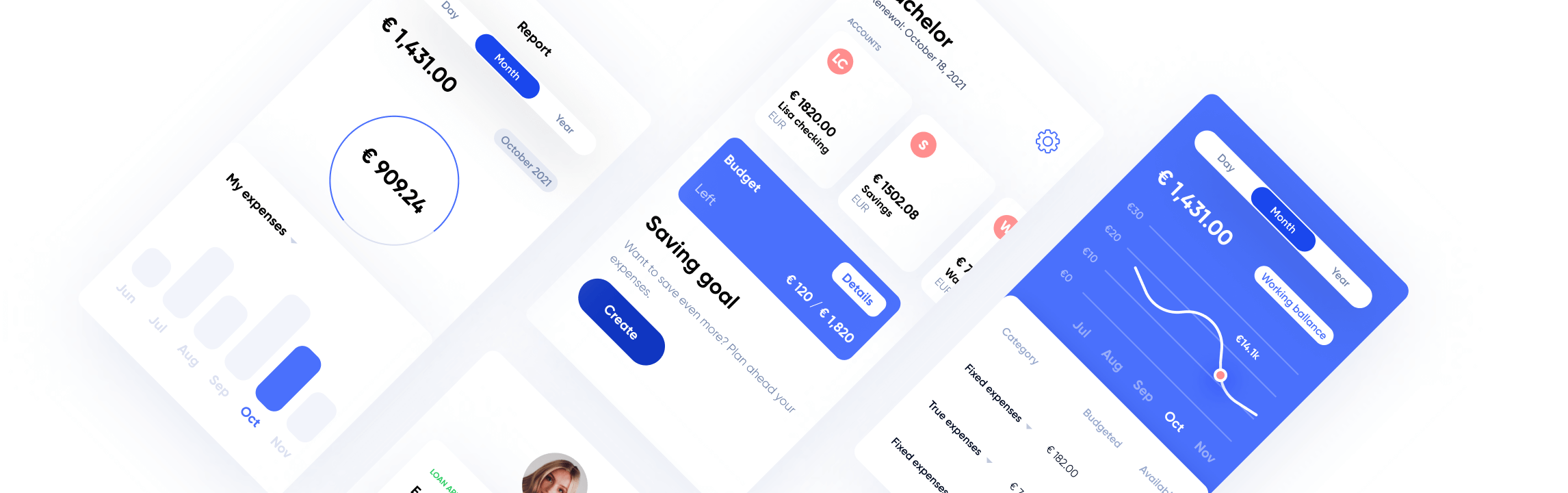

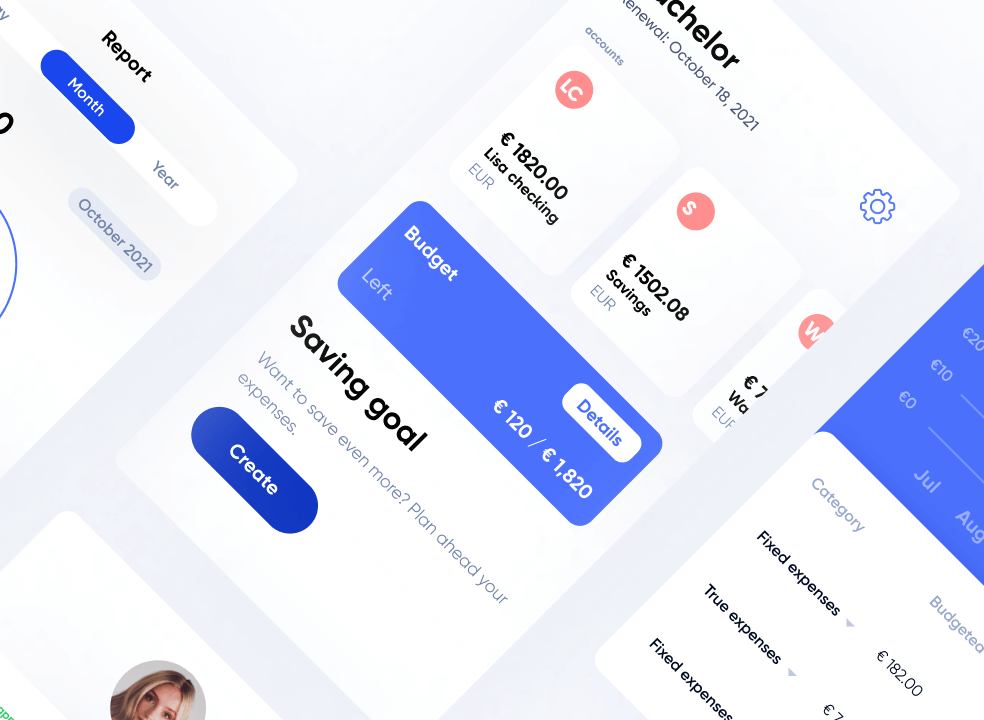

Digital boost to personal finances

Open banking transforms the way customers manage all their finances in your PFM app, enabling you to provide actionable budgeting advice and personalised saving recommendations.

Data directly from the bank

Eliminate exhausting manual entry of financial data

Get split-second access to accounts data of more than 5,000 banks in 50+ countries to fix the pain point of tedious manual financial data entry. Now end-customers can insert information from all their accounts, including current, saving, mortgage, investment, and loyalty automatically into your app in just one click.

Data enrichment

Offer useful insights and forecasts to your customers

Enable your customers to get a comprehensive picture of their financial health, customised budgeting, saving, investments tips to help them along their financial journeys. Equipping your app with great tools like high-precision transaction categorisation, merchants identification, financial advice will help them better manage their finances.

Smooth onboarding

Verify account ownership in a seamless and safe way

Onboard customers in just several clicks without having to ask a user to manually upload important information and documents. Check account details and ownership in seconds to drive customer engagement. Offer outstanding user experience by making onboarding effortless and safe.

Streamlined payments

Let your users pay by bank straight from your app

Empower your customers to initiate open banking-enabled payments securely straight from your app or website. Budget wisely, set alerts for payments’ due dates and credit limits. Offer your users the option to transfer funds between accounts, pay friends and family, and even pay their bills without leaving your app.

Client testimonials

A digital makeover to personal finances via open banking

Meet companies that took their customers’ experience to new levels using Salt Edge tech-forward solutions

Oval Money Co-founder

Claudio Bedino

Oval Money - Personal Financial Assistant

One useful attraction of our app is the account aggregation feature that allows our users to see all their income and expenses in one place and then use these insights to make informed financial decisions and personalise their saving and investing experience in the app. Salt Edge has enabled us to offer this service to our users.

CEO at Fast Budget

Alex Ferraroni

Fast Budget partners with Salt Edge to provide a fully automated way to manage daily finances

Leveraging Salt Edge’s bank data aggregation technology, our users can manage their finances seamlessly, taking the fuss and bother out of the process. We are excited to join hands with like-minded companies to unlock the benefits of open banking and to give our customers a great and personalised PFM experience.

Salt Edge toolbox

Why you should choose us

Coverage

Access the open banking data from 5,000+ financial institutions in over 50 countries with Salt Edge

Go live in 15 minutes

Choose the shortest path to discover countless open banking opportunities

Instant payment

Pay by any bank from Europe, faster and more secure

Highest security standards

ISO 27001 certified and PSD2 licensed, Salt Edge employs the highest international security standards to initiate payments and access financial data

Data enrichment

Value-added services for complete financial behavior analysis: merchant identification, financial insights, business and personal transaction categorisation

We’ve got you covered

Salt Edge handles all the technical, security, compliance matters for you