Real-time data source

Streamline the application and onboarding processes

Start using real-time financial data including KYC details, account numbers, personal and business data directly from banks across all Europe and beyond. Fill in all the necessary data automatically to reduce friction, eliminate errors, speed-up onboarding and improve customer experience.

Income & identity verification

Strike out credit risk from your list

Refine the underwriting process by validating the identity and account information in several clicks. Check instantly the sources of income including basic salary, freelance, dividends, abroad, and mitigate risks associated with outdated and false information. Eliminate manual checks and prevent fraud by immediate data verification.

Financial insights & expense analysis

Predict the future by improving your credit scoring

Enhance the accuracy of credit scoring calculations by developing a faster and more reliable credit assessment model. Sophisticated pattern recognition and machine learning algorithms deliver enriched data that helps you analyse your customers’ financial health.

Instant decisioning

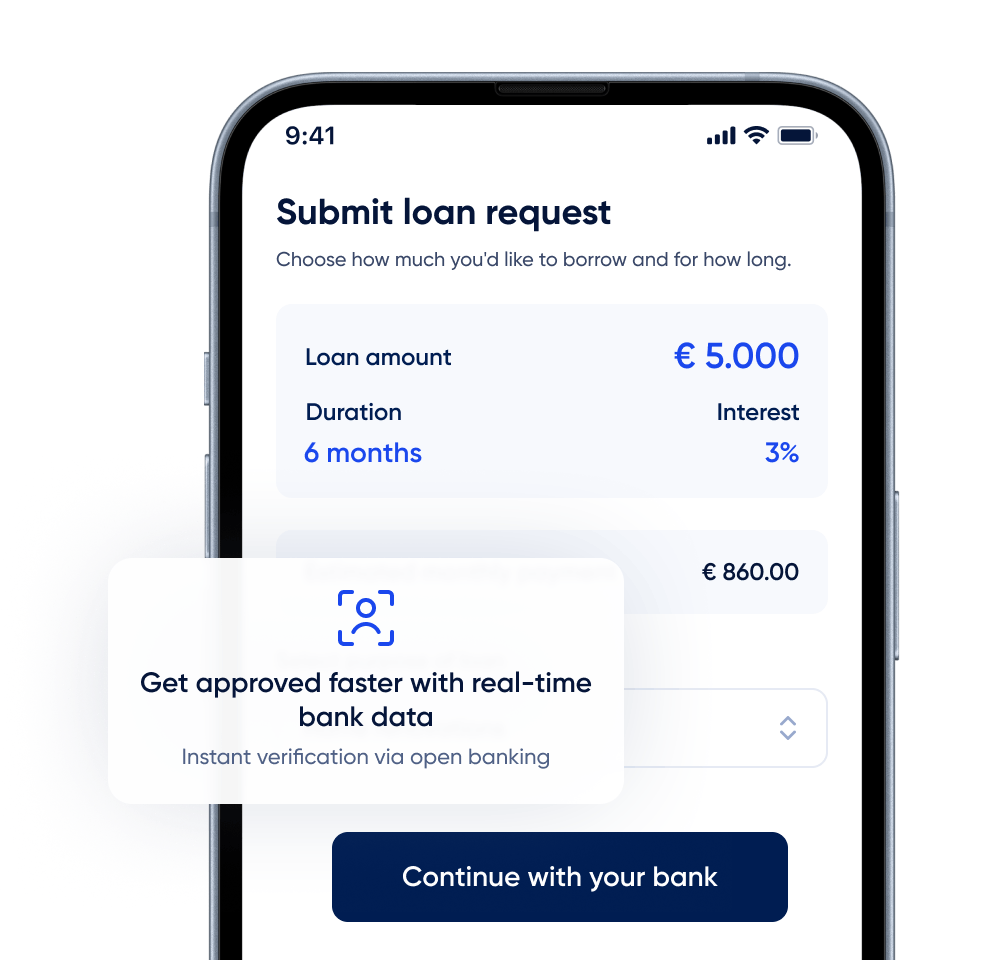

Boost your credit decision from days to minutes

Make lending decisions quickly and easily, one, two, three. Stop requiring borrowers to physically bring documents. Real-time financial data coming directly from users’ bank accounts into your software empowers you to make lending decisions in a split second.

Simpler payments

Pay and get paid back more easily

Enable your customers to easily initiate loan repayments directly from their bank accounts, without needing to leave your app or website. Allowing credit disbursement and setting automatic payment requests straight in your app or website makes the payment experience more convenient. Easy and fast without cards or hidden fees from other payment processors.

Data-driven upselling

Power smarter SME lending and upselling

Create tailored loan offers for SME clients based on real-time financial data. Once consent is granted, continue accessing their account information for up to 180 days, allowing you to monitor cash flow patterns and business performance. This ongoing insight enables you to identify upsell opportunities, offer better-suited financial products, and strengthen long-term client relationships.